In an era where Artificial Intelligence (AI) is seamlessly integrated into various facets of digital…

How Do You Conduct Market Research in Singapore For SMEs?

Definition and Importance

Market research is the process of collecting and analysing information about a market’s size, trends, demographics, and competitor activities. This data helps small and medium-sized businesses (SMEs) understand the current conditions and potential changes in their market, enabling them to make informed decisions about product development, marketing strategies, and more. In a diverse and competitive market like Singapore, where consumer preferences can vary widely across different ethnic and demographic groups, market research is crucial. It helps businesses tailor their offerings to meet specific needs and preferences, thereby increasing their chances of success. Once you’ve completed this blog, you’ll be equipped to conduct in-depth market research for your startup as effectively as a professional market research analyst.

Market research is the process of collecting and analysing information about a market’s size, trends, demographics, and competitor activities. This data helps small and medium-sized businesses (SMEs) understand the current conditions and potential changes in their market, enabling them to make informed decisions about product development, marketing strategies, and more. In a diverse and competitive market like Singapore, where consumer preferences can vary widely across different ethnic and demographic groups, market research is crucial. It helps businesses tailor their offerings to meet specific needs and preferences, thereby increasing their chances of success. Once you’ve completed this blog, you’ll be equipped to conduct in-depth market research for your startup as effectively as a professional market research analyst.

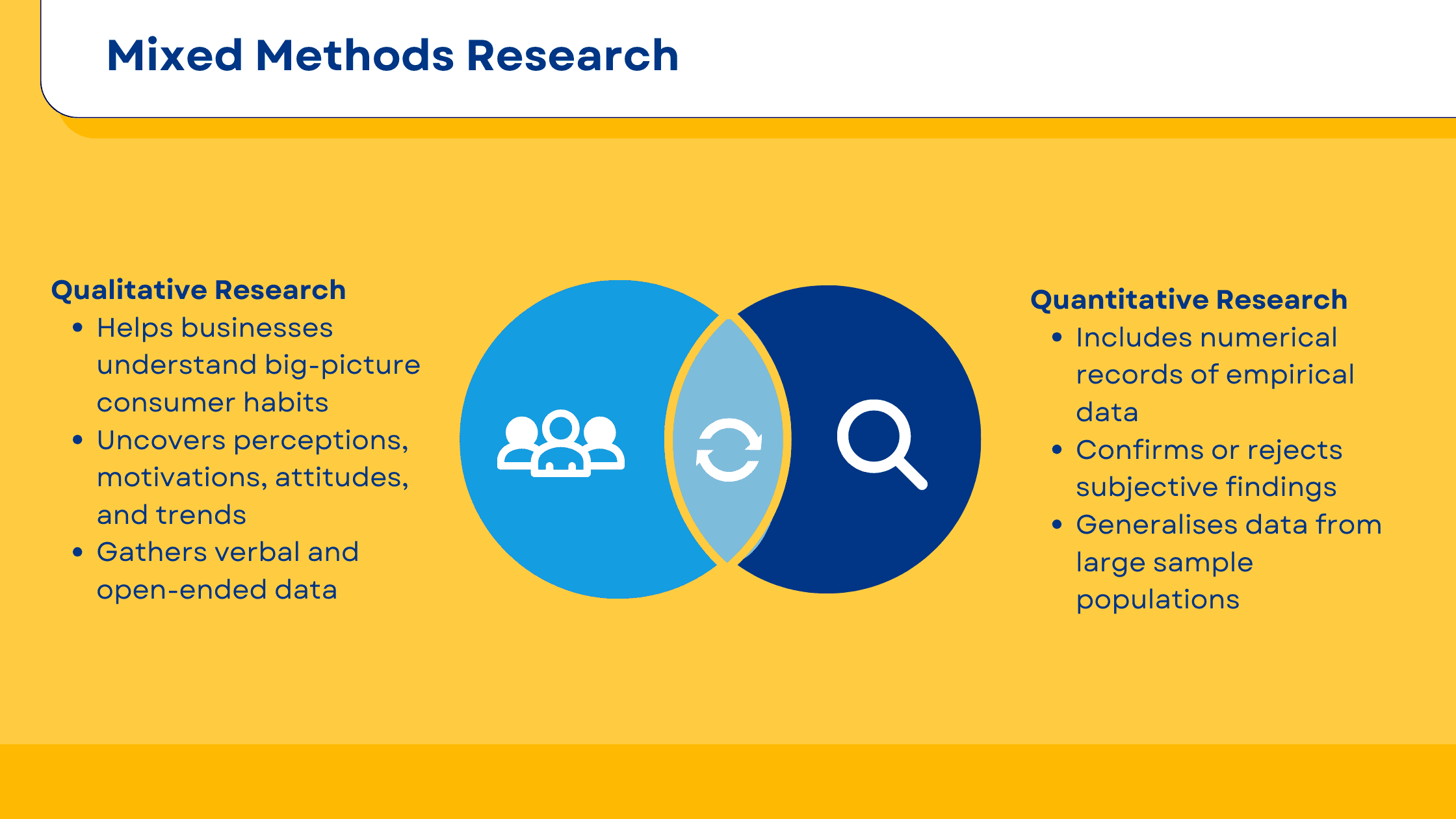

Types of Market Research: Qualitative vs. Quantitative

Market research can broadly be categorised into three types: qualitative, quantitative, and mixed Methods.

Qualitative Research

This type involves gathering non-numerical data to understand concepts, thoughts, or experiences. It can provide deep insights into consumer attitudes, motivations, and behaviours through methods such as focus groups, in-depth interviews, and observation. Qualitative research is particularly useful for exploring new ideas or obtaining detailed feedback on existing products or services.

Quantitative Research

In contrast, quantitative research involves collecting and analysing numerical data to quantify opinions, behaviours, or other defined variables—and generalise results from a larger sample population. This type of research often uses surveys, questionnaires, and statistical data to identify patterns or test hypotheses. It is valuable for assessing market size, measuring customer satisfaction, and gauging the effectiveness of marketing campaigns.

Mixed Methods Research

Mixed methods research combines qualitative and quantitative techniques to provide a comprehensive understanding of market trends. This approach integrates the depth of qualitative insights with the breadth of quantitative data to offer a more complete picture of the market.

Key Features:

- Integrated Data: Uses both numerical data and non-numerical insights.

- Phased Approach: Typically conducts qualitative research to explore ideas, followed by quantitative research to test hypotheses or vice versa.

- Triangulation: Corroborates evidence from different sources to validate findings and enhance reliability.

Benefits for Singapore’s Market:

- Holistic Insights: Enables businesses to understand both the magnitude and nuances of customer behaviours and market dynamics.

- Strategic Decision Making: Provides robust data to support informed decisions in product development, marketing, and customer experience strategies.

Low-Cost Market Research Methods

Surveys and Questionnaires

Surveys and questionnaires are invaluable tools for quantitative market research due to their ability to gather extensive data directly from the target audience. They can be efficiently managed even with a modest budget, making them ideal for startups and small enterprises in Singapore.

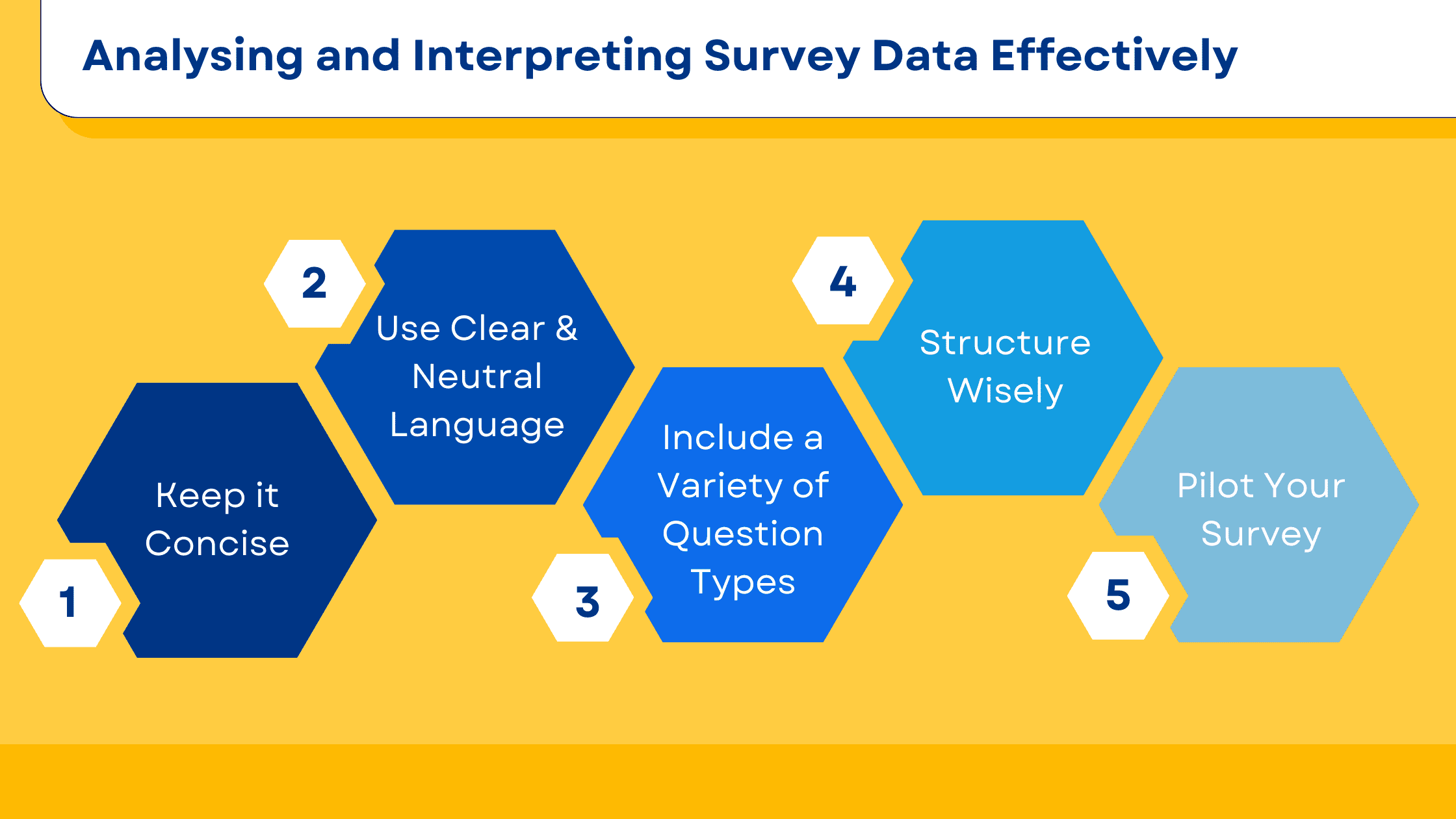

5 Tips on Designing Effective Surveys

- Keep it Concise: Lengthy surveys often lead to lower completion rates. Ensure that your survey can be completed in 5-10 minutes. Only include questions that provide insight into your specific objectives.

- Use Clear and Neutral Language: Questions should be straightforward and free from complex jargon or leading terms that could bias responses.

- Structure Wisely: Start with broader questions to ease respondents into the survey and follow with more specific questions. Group similar questions to keep the survey logically organised.

- Include a Variety of Question Types: While multiple-choice questions are easy to analyse, occasionally using open-ended questions can provide deeper insights into the thoughts and feelings of respondents.

- Pilot Your Survey: Before full deployment, test your survey with a small, diverse group to identify any confusing questions or technical issues.

3 Recommendations for Free or Low-Cost Online Tools

- Google Forms: An excellent free tool that allows you to create custom surveys quickly. It is particularly user-friendly, integrates easily with other Google applications, and automatically collects data into Google Sheets for easy analysis.

- SurveyMonkey: Offers a free basic plan that includes essential features for survey design, deployment, and data analysis. For more advanced features, their paid plans are reasonably priced and offer more robust data analysis tools.

- Typeform: Known for its user-friendly interface and design, Typeform allows creation of visually appealing surveys that are engaging for respondents. It offers a free version with basic features, which is adequate for many small-scale research projects.

How to Take Advantage of Digital Tools and Social Media?

Social Media Listening

Online tools and social media platforms are essential for conducting cost-effective market research, particularly for businesses in Singapore working within tight budgets. These resources not only facilitate extensive data collection on consumer behaviour and market trends but also allow for real-time monitoring and analysis.

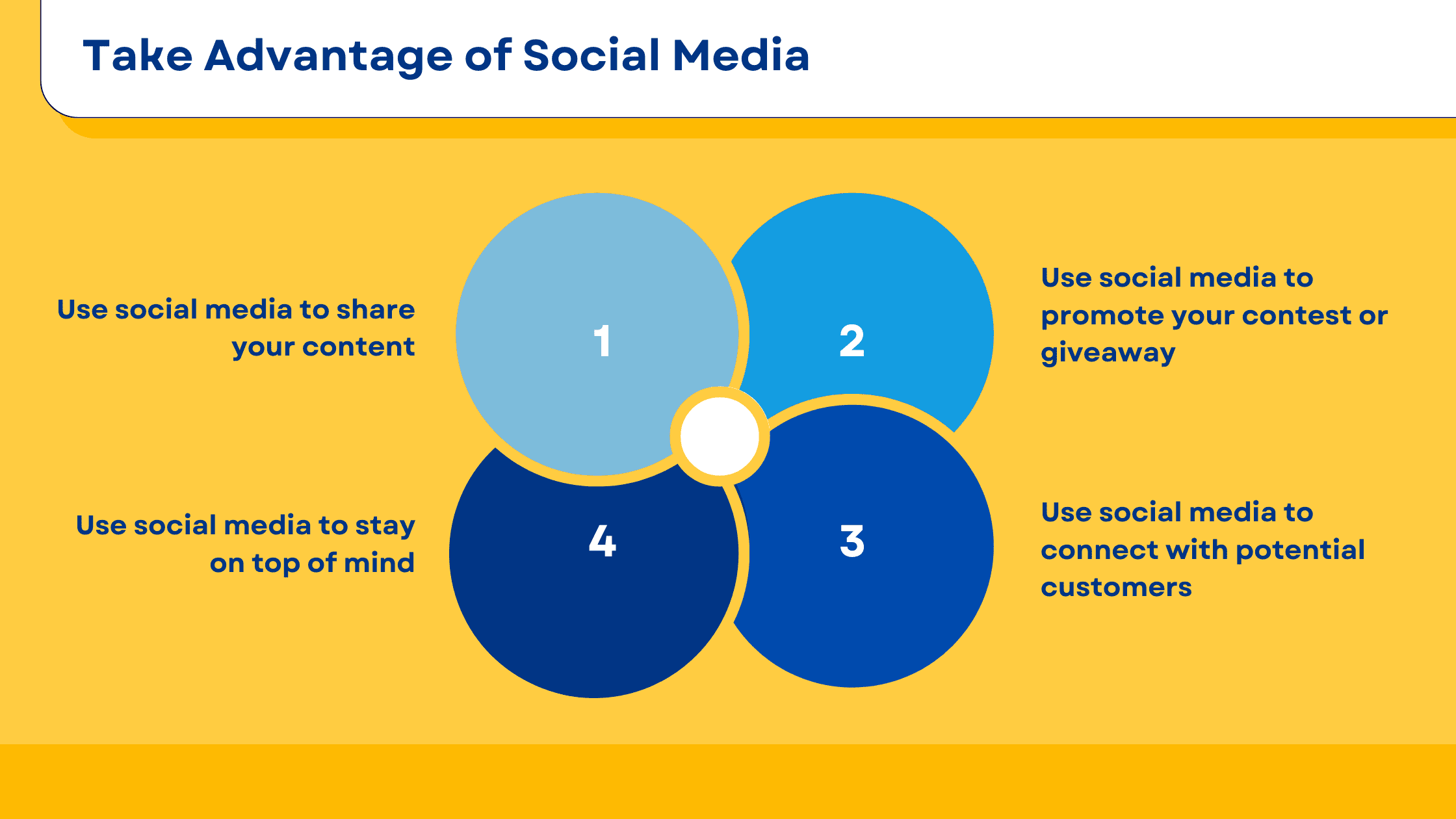

- Use social media to share your content:

Sharing content on social media platforms can greatly enhance its visibility and reach. This can include blog posts, videos, new product announcements, and more. By consistently sharing content, you increase the likelihood of it being seen and shared by others, thus expanding your audience.

- Use social media to promote your contest or giveaway:

Social media is an excellent channel for promoting contests or giveaways, which can engage your audience and encourage participation. Promotions like these can also increase brand visibility and attract new followers who are interested in what you’re offering.

- Use social media to connect with potential customers:

Platforms like X, Facebook, and Instagram offer direct ways to connect with potential customers. Engaging with users through comments, messages, and posts can help build relationships and foster trust in your brand.

- Use social media to stay top of mind:

By regularly posting relevant and engaging content, you can keep your brand at the forefront of your audience’s mind. This ensures that when they’re ready to make a purchase, your brand is the first one they think of.

Free tools for monitoring social media trends and conversations include:

- X Pro: Ideal for X, it allows users to track tweets, hashtags, and mentions in real-time, providing insights into current trends and public opinions. This is a subscriber-only feature on X and it costs SGD114 per year.

- Hootsuite: With its free version, businesses can manage multiple social media profiles, schedule posts, and track keywords across platforms, helping to keep tabs on industry-specific discussions.

- Social Mention: This tool aggregates content from various social media sources into a single stream of information, offering insights into frequency of mentions, range of influence, and other relevant metrics.

Google Analytics

Google Analytics offers comprehensive tools for tracking website activity, which is essential for understanding audience behaviour and improving online marketing strategies.

Basic tutorial on using Google Analytics for audience analysis and behaviour tracking:

- Setup: Create a Google Analytics account, add your property (website), and insert the tracking code into your website’s HTML.

- Audience Analysis: Use the Audience reports to determine demographics, interests, and geolocation of your site visitors, helping you to tailor your marketing efforts more effectively.

- Behaviour Tracking: The Behaviour section provides data on user engagement, such as page views, bounce rates, and average session duration, which are key metrics for evaluating content effectiveness.

- Acquisition Overview: This report shows how users find your site, whether through search engines, social media, direct traffic, or referral sites, allowing for refined acquisition strategies.

Online Competitor Analysis

Conducting an online competitor analysis is vital for understanding your market position and identifying areas for improvement.

Steps to conduct a competitor analysis using free online resources:

- SEO and Website Performance: Tools like Ubersuggest or Moz’s Link Explorer provide insights into competitors’ website traffic, keyword rankings, and backlink profiles.

- Social Media Comparison: Analyse competitors’ social media profiles for engagement rates, content strategy, and audience growth, which can offer clues about effective communication tactics.

- Customer Reviews and Feedback: Platforms like Google Reviews and industry-specific forums are valuable for gauging customer satisfaction and reputation concerning competitors.

- Google Alerts: Set up Google Alerts for competitor names and key industry terms to receive updates on their activities, new products, or other relevant news.

Make Use of Publicly Available Data

For businesses in Singapore operating on a budget, publicly available data sources provide a treasure trove of valuable information that can enhance market research efforts without incurring high costs.

Government and Industry Reports

Singapore’s government and various industry bodies regularly publish reports that are rich with insights into economic conditions, industry trends, and consumer demographics. These resources are often free and can be accessed easily to inform business strategies.

Information on accessing Singapore government and industry sector reports:

- Singapore Department of Statistics (SingStat): Offers comprehensive statistics on a wide range of economic, social, and demographic trends. Businesses can access data on consumer spending, imports and exports, and population demographics.

- Enterprise Singapore: This agency publishes industry insights and guides that are particularly useful for small and medium enterprises looking to understand market conditions and opportunities.

Examples of useful public databases and resources:

- Data.gov.sg: This portal provides a variety of government datasets that are useful for businesses looking to analyse trends across sectors like transportation, finance, and healthcare.

- Urban Redevelopment Authority (URA): Offers real estate data and statistics that can be crucial for businesses involved in property development, retail, or those considering physical location expansions.

Academic Research and Libraries

Universities and other academic institutions are excellent sources of high-quality, detailed research. Many of these resources are accessible online and can be invaluable for deepening understanding of specific market aspects.

How to use university libraries and online academic resources that are open to the public:

- National Library Board of Singapore (NLB): Provides access to a wealth of digital resources including books, journals, and newspapers. Business owners can use the NLB’s e-resources for detailed studies on market trends and historical data.

- University Libraries: Institutions like the National University of Singapore (NUS) and Nanyang Technological University (NTU) often allow public access to their digital resources and physical libraries. These can be great places to find academic papers, industry reports, and case studies specific to the Singapore market.

- Google Scholar: For accessing freely available academic articles, Google Scholar offers a broad search of scholarly literature across many disciplines and sources.

DIY Market Research

Conducting your own market research can be a highly effective and economical way to gather insights without the need for external agencies. This section provides practical tips and successful examples of DIY market research activities that businesses in Singapore have used to gain valuable market intelligence.

5 Tips for Conducting DIY Market Research

- Define Clear Objectives: Before starting your research, clearly define what you want to achieve. Whether it’s understanding customer preferences, testing product concepts, or evaluating market size, having specific goals will guide your research methods and data collection.

- Use Existing Customer Data: Analyse data you already have, such as sales records, customer service interactions, and website analytics. This information can provide initial insights into who your customers are and what they prefer.

- Engage Directly with Customers: Tools like customer surveys, feedback forms, and direct interviews can be invaluable. Organise informal focus groups with a small number of target customers to discuss their needs and perceptions of your product or service.

- Observe the Competition: Visit competitor locations, explore their websites, and analyse their marketing tactics. Seeing what the competition is doing can help you identify industry standards, trends, and gaps in the market.

- Use Social Media Platforms: Monitor social media to see what customers are saying about your brand and competitors. This can also be a great way to engage directly with customers and gather informal feedback.

Examples of Successful DIY Market Research in Singapore

- Local Cafe Chain: A local cafe chain used customer feedback forms and social media polls to determine which new menu items to introduce. The direct customer input helped them successfully launch products that were well-received and increased repeat visits.

- Tech Start-up: A tech start-up utilised LinkedIn and Facebook groups targeted at their niche market to conduct informal surveys and discussions. This provided them with specific insights into the software features most desired by potential users, guiding their development priorities.

- Retail Store: A retail store in Singapore conducted an observational study by tracking which store areas and products attracted the most customers. They used this data to optimise the layout of their store and improve product placement, resulting in increased sales.

These DIY methods not only help in saving costs but also foster a direct connection with the target audience, providing real-time, actionable insights that are crucial for making informed business decisions. By implementing these approaches, small businesses and startups in Singapore can conduct effective market research tailored to their specific needs and constraints.

8-Step Guide to Conducting Market Analysis in Singapore for SMEs

Step 1: Define Your Objectives

- Clarify Goals: Determine what you want to achieve with your market analysis. This could be understanding customer demographics, assessing competitor strategies, or identifying market trends.

- Key Questions: Develop key questions that your market analysis needs to answer. This helps in focusing your research efforts and ensuring relevance to your business needs.

Step 2: Segment Your Market

- Identify Segments: Break down the market into manageable segments such as demographics (age, gender), psychographics (lifestyle, values), or geographic areas.

- Focus on Relevant Segments: Select the segments most relevant to your business goals for a more targeted analysis.

Step 3: Collect Data

- Primary Research: Conduct surveys, interviews, and focus groups to gather firsthand information from customers and stakeholders. Use tools like Google Forms or SurveyMonkey for cost-effective survey distribution.

- Secondary Research: Use existing data from government publications, industry reports, and academic research. Websites like Data.gov.sg and the Singapore Department of Statistics (SingStat) are valuable resources.

Step 4: Analyse Competitors

- Identify Key Competitors: List major competitors in your market and gather data about their operations, products, and marketing strategies.

- SWOT Analysis: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) for each competitor to understand your own market position relative to others.

Step 5: Evaluate Market Trends

- Current Trends: Look at current market trends affecting your industry. This might include changes in consumer preferences, technological advancements, or regulatory changes.

- Forecast Future Trends: Use the collected data to predict future trends. This could involve analysing patterns in consumer behaviour or advancements in technology relevant to your industry.

Step 6: Assess Customer Needs and Preferences

- Customer Surveys and Feedback: Analyse data from customer surveys and feedback to determine what customers value in products or services similar to yours.

- Focus Groups: Conduct focus groups to get deeper insights into customer motivations, preferences, and dissatisfaction factors.

Step 7: Develop Strategies Based on Insights

- Look at Insights: Use the insights gained from the market analysis to tailor your marketing strategies, product development, and other business strategies.

- Actionable Steps: Create actionable steps based on the data to address market opportunities or challenges identified during the analysis.

Step 8: Monitor and Update

- Continuous Monitoring: Regularly monitor market conditions and your business performance to stay ahead of any significant changes.

- Iterative Process: Treat market analysis as an ongoing process. Revisit and update your analysis regularly to ensure your strategies remain relevant and effective.

Case Studies

For real-life examples and more detailed case studies, visiting specific industry publications, local business news websites, or academic journals that focus on business and marketing in Singapore would be beneficial. However, platforms like the National Library Board of Singapore and business news sections of major Singapore newspapers often contain relevant case studies and business analysis articles that are accessible and citable.

Conclusion

We’ve explored various affordable market research strategies for businesses in Singapore, from using digital tools like Google Analytics and social media listening to using public data and DIY approaches. These methods demonstrate that effective market research is achievable on a tight budget. Embrace these innovative strategies to gather crucial insights, make informed decisions, and remain competitive in your market. Start implementing these techniques today and see the transformative impact they can have on your business’s growth and success.

Further Reading and Resources

For those keen on deepening their market research knowledge and finding additional tools, here is a curated list of online resources, tools, and further readings that can assist you in your market research endeavours:

Online Tools and Platforms

- Google Analytics – Google Analytics

- A must-use tool for tracking website performance and consumer behaviour online.

- SurveyMonkey – SurveyMonkey

- An easy-to-use tool for creating and distributing surveys to gather customer feedback.

- Hootsuite – Hootsuite

- Manage and monitor your social media accounts to gauge public sentiment and trends.

- SEMrush – SEMrush

- Useful for SEO and online competitor analysis, providing insights into competitors’ strategies.

Educational Resources

- HubSpot Academy – HubSpot Marketing Courses

- Offers free courses on various aspects of digital marketing, including market research techniques.

- Coursera – Market Research Courses

- Provides a range of courses and tutorials related to market research and data analysis.

- Khan Academy – Statistics and Probability

- Free resources to help you understand the fundamentals of statistics, useful for analysing market research data.

Reading Material

- The Lean Startup by Eric Ries – Offers insights on how startups can use continuous innovation to create radically successful businesses, including how to conduct effective market research with minimal resources.

- Marketing Research: An Applied Orientation by Naresh K. Malhotra – Provides comprehensive coverage of the various aspects of market research, suitable for both students and professionals.

- Singapore Department of Statistics – SingStat

For official statistics and reports that provide a macro view of economic and demographic trends in Singapore.